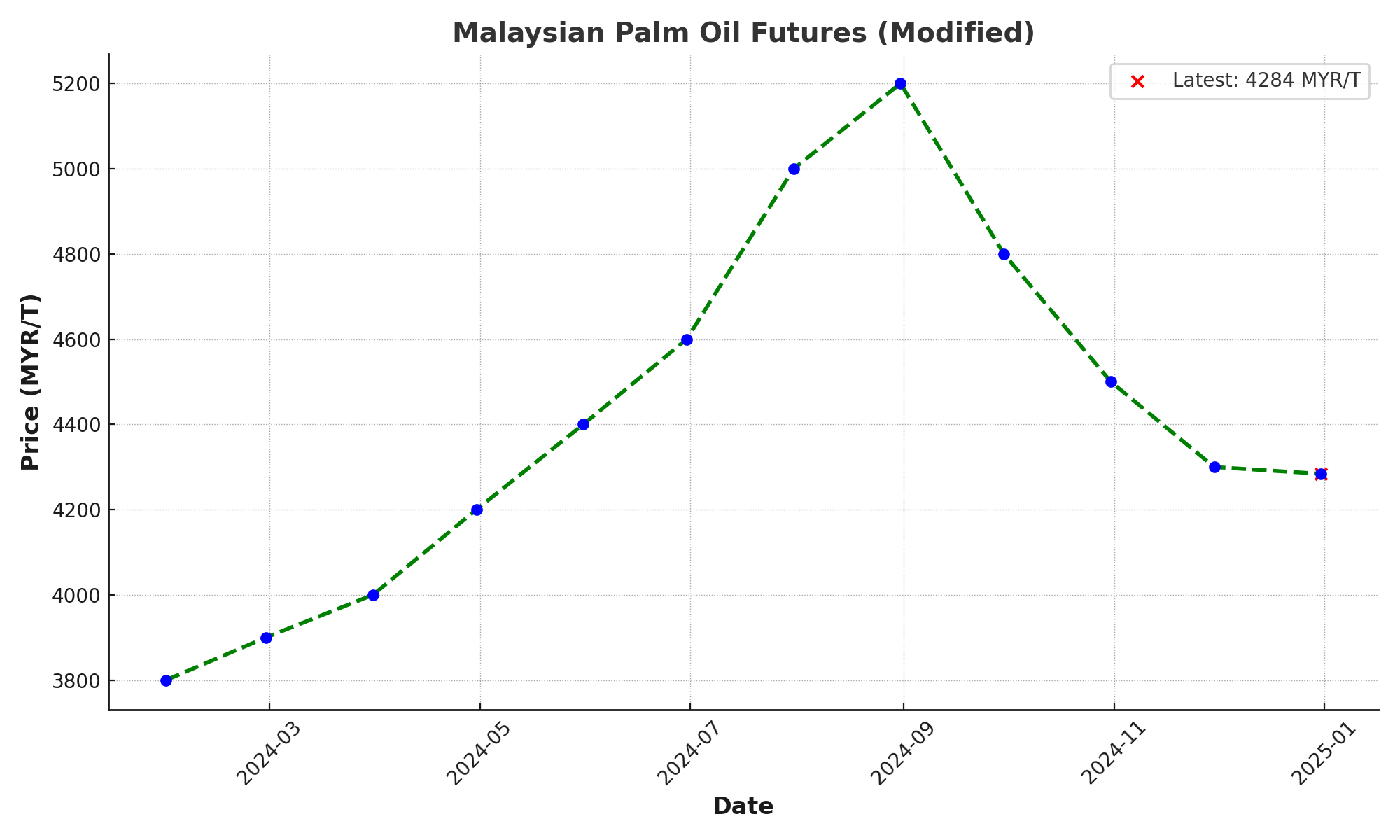

Malaysian palm oil futures fell nearly 3%, dropping below MYR 4,250 per tonne, their lowest since late October, marking the third consecutive session of losses. The decline was attributed to weak exports, with shipments from January 1-15 expected to decrease by 15.5% to 23.7% compared to the same period in December, according to cargo surveyors. In India, the largest buyer, palm oil imports dropped 41% month-on-month in December, hitting a 9-month low due to the availability of cheaper alternative edible oils. Overall demand in the first quarter is anticipated to remain weak, despite a possible increase in Chinese purchases during the Lunar New Year. Traders are also awaiting key economic data from China, including Q4 GDP, industrial production, and retail sales figures. However, the decline was limited by December industry data showing a third consecutive drop in inventories and an 8.3% decrease in output. Additionally, the Malaysian Palm Oil Board pointed to concerns over tight global supplies this year due to Indonesia’s B40 biodiesel mandate, expected growth in U.S. biodiesel demand, and potential changes in U.S. crop production.

Palm oil futures and current